There are fears of a recession and stocks are selling off while the Federal Reserve is set on raising interest rates. What happens in the months or years to come will be a direct result of the years that came before. Just as the descent on a roller coaster is a result of the rise, so is it in our current economic situation. Inflationary policy, a policy of increasing the money supply to promote financial growth, is the absolute reason we find ourselves at the brink of another economic crisis. Previous attempts in history to stimulate the economy not through savings and investments but through an increase in the money supply have predominantly led to disaster. This article looks at the last two years of monetary and fiscal policy and their effects on the economy through the lens of the Austrian Business Cycle Theory as developed by Professors Ludwig von Mises, F.A. Hayek, and Murray Rothbard.

I begin by acknowledging that no single event or time period can be surgically removed from the events which precede it. All points in time are built upon all previous history and cannot be separated from any relevant or at times irrelevant events which preceded. Current perceptions of reality are based upon all understandable information and man’s understanding of past events. With all that in mind, I will only deal with a two-year time span which certainly has been created on foundations of earlier actions. I choose to focus on the last two years, a period of compacted and manic events which possibly contained a complete boom phase of a business cycle.

Zero Interest Rate Policy and Credit Expansion

We begin with the policies of the US government and FED in dealing with the onset of the Global Crisis in March of 2020 to stimulate the economy by expanding money and credit in a scale never seen before. They lowered the base interest rate to zero, and added enormous amounts of liquidity to the market by creating new money through monetary and fiscal policy. The FED not only expanded its balance sheet, but the government increased the amount of money directly held by citizens(M2) to historic and never before seen quantities.

The graph below (Fig. 1) shows the extent to which the FED expanded their balance sheet after the Great Financial Crisis in 2009 (Doubling from $1B to $2B approx.), subsequent increases over the next decade, and another doubling at the onset of the latest crisis in March 2020 (from $4B to $9B approx.).

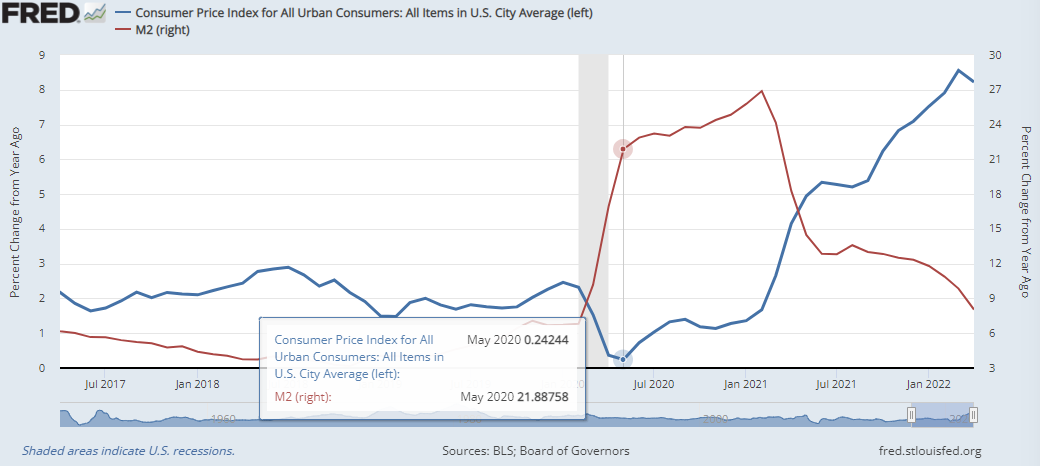

In the next graph (Fig. 2) , the blue line represents the total quantity of money (M2) in the hands of the public, while the red line shows M2’s rate of change YTD. At its peak in 2020, M2 rose by 27% when compared to the year before. A staggering and historic change which introduced large sums of money directly into the hands of the American public.

This new money “enriched” consumers and producers, all while government enforced lockdowns were happening, which kept people from consuming. Forcing people to stay home with lockdowns was like shutting the economic floodgates of the newly created money. Inflation, a phenomena which can be expressed by rising prices, happens when there is a sudden increase in the quantity of money without a change in the demand for holding that money. Or more precisely, when the ratio of money supply to demand for money rises. It happens when quantities of money not before present, enter the market through transactions. This can occur either by creation of new money which is then spent into the economy, or a broad decrease in the public’s demand for holding money. In both cases, there is an increase in the amount of money competing for the same goods and services. More units of a money entering a market will cause the marginal value of each unit to drop. As the money unit is valued less, sellers will raise prices or real goods against the money which is diminishing in value.

Artificially increasing the amount of money held by the public does not make anyone wealthier, it just puts more money into their hands. For example, if we all woke up tomorrow and every single person’s money holdings were magically doubled, would anyone be twice as wealthy?

No. Prices would rise to accommodate the new levels of cash in the society.

When new money is introduced into the economy, the public is deceived into feeling wealthier and going to spend their new “riches”. As a result of this, sellers raise their prices in an attempt to maximize their profits, a normal and predictable reaction. Because of lockdowns and restrictions however, creating the new money had no effect until it was allowed to permeate into the economy. It was similar to over-filling a dam with water while the floodgates were closed. As long as the flood gates are not opened, there is no effect to the water levels on the river below the dam. Once released however, the new money created massive disruptions in the economy, raising prices violently as sellers suddenly experienced astronomical demand against a fixed supply (and high level of uncertainty), just like a release of the floodgates would do for water levels.

The chart above (Fig.3) shows the rate of inflation rising significantly with the introduction of the new money in 2020-2022. It is prudent to take into consideration that although the CPI looks low compared to the late 70’s, this may be misleading as the US Bureau of Labor and Statistics alters the calculation method with hedonic adjustments and other changes and omissions to how they record inflation. There are reasons to believe that the rate of inflation today is much closer to levels seen in the late 70’s and early 80’s. For reference, here is the same chart with the M2 (Money Supply) 12 Month Change on top of it in red (Fig.4 ).

If we zoom in, it becomes clear that inflation (blue line below) starts to really pick up after the rate of M2 change is close to peak levels at ~22% YTD (red line below)…

The influx of new money changed the prices of goods and services all across the economy as consumers competed for places to spend their freshly printed money1. This occurred at the same time while consumption demand was at all-time highs due to government restrictions and lockdowns and the public’s cash holdings being higher than usual. Businesses also had access to new funds they acquired through cheap loans at low interest rates. As people were hesitant to return to work, wages needed to rise to incentivize people to take on jobs, causing even higher inflation and price instability. The combination of injecting the public with new money, and keeping spending restricted had disasters effects once people were free to spend their new money. When lockdowns eased off, higher quantities of money in the hands of the public were released to compete for the same goods and services, causing prices to rise as a reaction. This boom of the economy may for a short while seem like growth, but since it is stimulated by an increase in money and not savings, it actually becomes a period of capital consumption disguised as growth.

Unsustainable Economic Growth

Economic growth caused by credit expansion is not sustainable, and as soon as the monetary expansion stops or declines to grow at the same rate, a crash is eminent. The only sustainable form of economic growth is one that results from increased levels of savings and investment by a restriction of consumption. During credit expansion perceptions are distorted into forecasting high future demand when in reality economic activity is stimulated by new quantities of money. The process of new money entering the economy varies according to how the money is injected into the market. During the last two years, money was directly given to consumers’ bank accounts and to producers through loans and grants. In the case of consumers, they suddenly have more money than they previously thought was necessary to hold, and so they spend it. As people have more money, they value each unit of the money less and try and off-load their savings into other goods and services. The introduction of the new money into the market distorts the perspectives of both producers and consumers substantially and causes changes in behavior. Consumers suddenly look at their bank accounts and feel wealthier, springing them into increased consumption. Producers interpret the high levels of consumption as increased demand for their products and use their newly acquired money to invest in production expansion. Both sides do this without realizing that the purchasing power of the money will change in the near future because of their new spending and investment habits.

In a step by step dance, with each event and action setting off the following one, actors in the economy interact with one another, causing more and more changes in the market. All these events are initiated by credit expansion and rely on the central bank to continue increasing the money supply.

As the new money trickles into the economy like the lava of a recently errupted volcano, everything it comes in contact with is forever changed. This is what happens:

The public rushes to spend their new money as they feel wealthier and see a “surplus” in their accounts.

Producers see high demand for their products and so they raise prices to maximize profits and to find a market clearing price.

At first, consumers prices rising and do not yet understand what is going on. Due to the new supply of money, enough of the population is still able to clear the market and to continue purchasing at higher prices. However, marginal consumers such as fixed-income pension receivers are hurt by rising prices the most. The recent situation was unique since most people received money straight to their bank accounts, making a large percentage of the US population instantly “wealthier”. There were even groups in the US who received more money through stimulous and unemployment benefits than their regular jobs payed. As prices initially rise, there is consensus that the situation is only temporary and that prices will soon go back down. This is the “inflation is transitory” narrative that was pushed relentlessly by the mainstream media and decision makers. At this point a large amount of the public still believes this. Those who are convinced prices will drop, constraint their spending as they wait for lower prices.

Producers continue to experience high levels of demand and forecast this demand out into the future. They decide to invest in expanding production to meet demand. As many producers do this, production factor prices rise (wages, land, rent, raw materials). Factor prices rise as companies are hiring more people and investing in production expansion to meet new demand.

As wages are going up, consumers experience even buying power and continue purchases regardless of higher prices, keeping demand high. Competitive demand, brought about artificially by new money is bidding up prices of both producer and consumer goods. However, real resources are still limited and investments must be made to bring them to the market. Bringing real resources to the market is not as easy as printing money, it requires a lengthy structure of production and investment.

At this point, fewer and fewer people are still convinced that prices will eventually fall. Less and less consumers are practicing restraint on their purchases. The public’s perception is starting to shift away from “inflation is transitory”, and towards “inflation is here to stay”. If the vast majority of the public were to suddenly become convinced that rising prices will continue indefinitely, they would run out to buy anything they can before prices rise even higher. Since current prices are determined by the public’s perception of future prices, a public convinced of indefinite price hikes would make them happen. If the majority of people were to start buying more than they need just to lock in current prices, the economy would not be able to provide for such a demand, and the value of money would collapse. This would effectively lower the demand for the US Dollar toward zero, and cause an economic catastrophe and a destruction of our monetary system. The FED knows this very well, and must do something to change the people’s perspective and convince them that prices will drop. Currently, a last strand of restraint and faith in future price stabilization is holding the whole monetary system together!

The FED knows that inflation has gotten out of hand. Of course they continue to ensure the public that the situation is in complete control and that they have the “tools” to cool down inflation. The public’s confidence in the future stability of the banking system is the single most important element of the whole economy. Public confidence is the real glue that holds the monetary system together. If people loose faith in the US Dollar, they would rush to buy anything in an attempt to get rid of their money, and thereby, completely destroy the value of the Dollar. If the public becomes convinced that inflationary policy will continue indefinitely, they will flee to real assets and leave behind their faith in the money. In the words of the great economist Ludwig von Mises in “Human Action”,

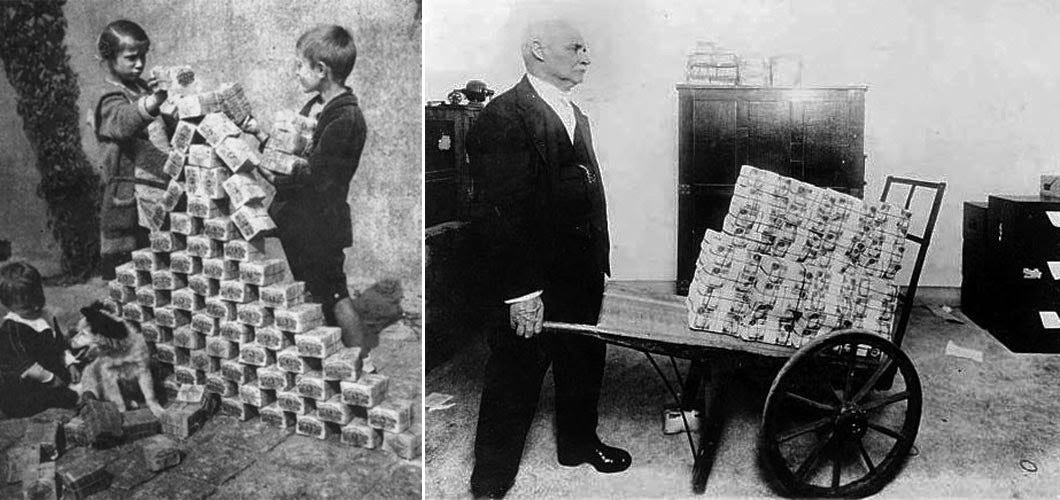

“But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against "real" goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

It was this that happened with the Continental currency in America in 1781, with the French Mandats Territoriaux in 1796, and with the German Mark in 1923. It will happen again whenever the same conditions appear. If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last forever.(Italics mine)

The FED has very blunt tools for making changes in the economy. They will try and reverse their expansionary action by tightening credit and increasing interest rates while debt levels are the highest they have been in history. They do this to make money more expensive and harder to come by, and to destroy demand for labor, demand for goods and services, and demand for capital. Unfortunately, due to high levels of debt, their real ability to raise interest rates is limited.

They are doing this right after the credit expansion has caused increases to wages, increased investments at high prices, and while consumer demand is sky high. The FED’s most powerful tool is not listed on their website under monetary tools. It is their ability to change the public’s sentiment and induce caution into the economy. If they can convince the people that they are set on tightening monetary policy, they may not have to really do it.

However, there is a possibility that due to fear, consumers will stop consuming, causing prices to drop. Meanwhile producers have invested in expanded production at high prices as a result of false demand forecasts. Those producers who made malinvestments would be forced to liquidate them or go out of business, causing a lowering of factor prices and mass unemployment. The inevitable end to the credit induced business cycle is recession.

Recession

The expansionary actions of the FED started a cycle which must eventually end in one of two possibilities: a destruction of the monetary system through hyperinflation if inflation doesn’t stop, or a recession to stabilize the previous effects of credit expansion. Both outcomes are painful and are the direct result of the previous credit expansion.

The recession is not a mythical monster which comes out of nowhere. It is a period where prices must fall below the unsustainable levels previously caused by credit expansion. During this period however, governments will typically drop interest rates and expand liquidity AGAIN to “help stabilize the economy”. Since the recession IS THE STABILIZOR which comes to offset the previous activity of the central bank, trying to ease the pain just postpones the problem even longer. This policy of lowering interest rates and deficit spending in a crash was the theory of John Maynard Keynes, and is the current popular monetary theory which dominates the world. It ignores the fact that the booms are caused by inflationary policy, while busts are just the adjustment periods that result as the central bank ceases this activity. After an artificial boom, a recession is inevitable. It must happen, and prices must go down and readjust as soon as the central bank stops pumping the system with new money. If the central bank continues to expand credit, they will cause hyperinflation and destroy the whole monetary system. This means that as central banks start begin QE (Quantitative Easing), they must eventually stop and tighten monetary policy to cause an economic downturn. Consequently, the best way to deal with these downturns is to let them play out and to not interfere by lowering rates again as was the case in the 1920-21 depression.

As politicians are typically concerned with elections, this becomes an unpopular policy and QE is often used as a way to postpone the mayhem somewhere into the future. Looking at a boom or a bust without seeing the full picture misses the point, the fact that these periods of calamity are caused by central bank interference and eventually cause pain and suffering to the masses.

What Does This All Mean?

The FED has created a very difficult situation for themselves by expanding credit on such a large scale in the last two years. On one hand they can choose to tighten monetary policy and induce a recession. On the other hand they can continue to inflate and risk hyperinflation and the destruction of the monetary system. They are stuck between an economic rock and a hard place, with no easy way out. The former option will hurt businesses and people while the latter would destroy the system the FED is in control of. The course of action they choose today should not be the main concern or takeaway from these events, but rather the focus should be on the implications of credit expansion on the economy and the disruptions and pain they cause each time inflationary policy is pursued. These are lessons we have experienced dating back to the times of antiquity but have yet to learn collectively.

As a conclusion, I leave you with a quote from one of the greatest economists in history.

“Clearly, the greater the credit expansion and the longer it lasts, the longer will the boom last. The boom will end when bank credit expansion finally stops. Evidently, the longer the boom goes on the more wasteful the errors committed, and the longer and more severe will be the necessary depression readjustment. Thus, bank credit expansion sets into motion the business cycle in all its phases: the inflationary boom, marked by expansion of the money supply and by malinvestment; the crisis, which arrives when credit expansion ceases and malinvestments become evident; and the depression recovery, the necessary adjustment process by which the economy returns to the most efficient ways of satisfying consumer desires.”

-Murray N. Rothbard, “America’s Great Depression”

Disclaimer:

None of the contents of this, or any of my articles are intended to be taken as financial advice. Please do your own research, and come to your own conclusions before making any investments based on the information provided here.

Regards,

Robert Rothbart

The FED does not really “print” money on a printer, they create it ex nihilo with the press of a button.